Borrowing and Minting: Understanding the two paths to stablecoin issuance

Stablecoin Musings #3

Stablecoins are designed to maintain a stable value, typically pegged to fiat currencies or commodities, addressing the volatility issues common in other cryptocurrencies.

Two main approaches to stablecoin issuance

Collateralized Stablecoins

Collateralized stablecoins are backed by reserves of assets. Among this, there are two primary types:

Fiat-collateralized: These stablecoins are backed one-to-one by traditional currencies held in reserve such as USDT and USDC. They offer simplicity and direct correlation with fiat currencies which makes them a popular choice for users seeking stability.

Crypto-collateralized: These stablecoins are backed by other cryptocurrencies. They employ more complex mechanisms such as over-collateralization to counteract the volatility of their reserves. MakerDAO's Dai is a good example.

Algorithmic Stablecoins

Algorithmic stablecoins rely on smart contracts and supply-demand dynamics to maintain their peg rather than being backed by tangible assets. They use algorithmic mechanisms to control supply and demand which aims to maintain their value through programmatic means. More on this will be delved further in another publication of Stablecoin Musings.

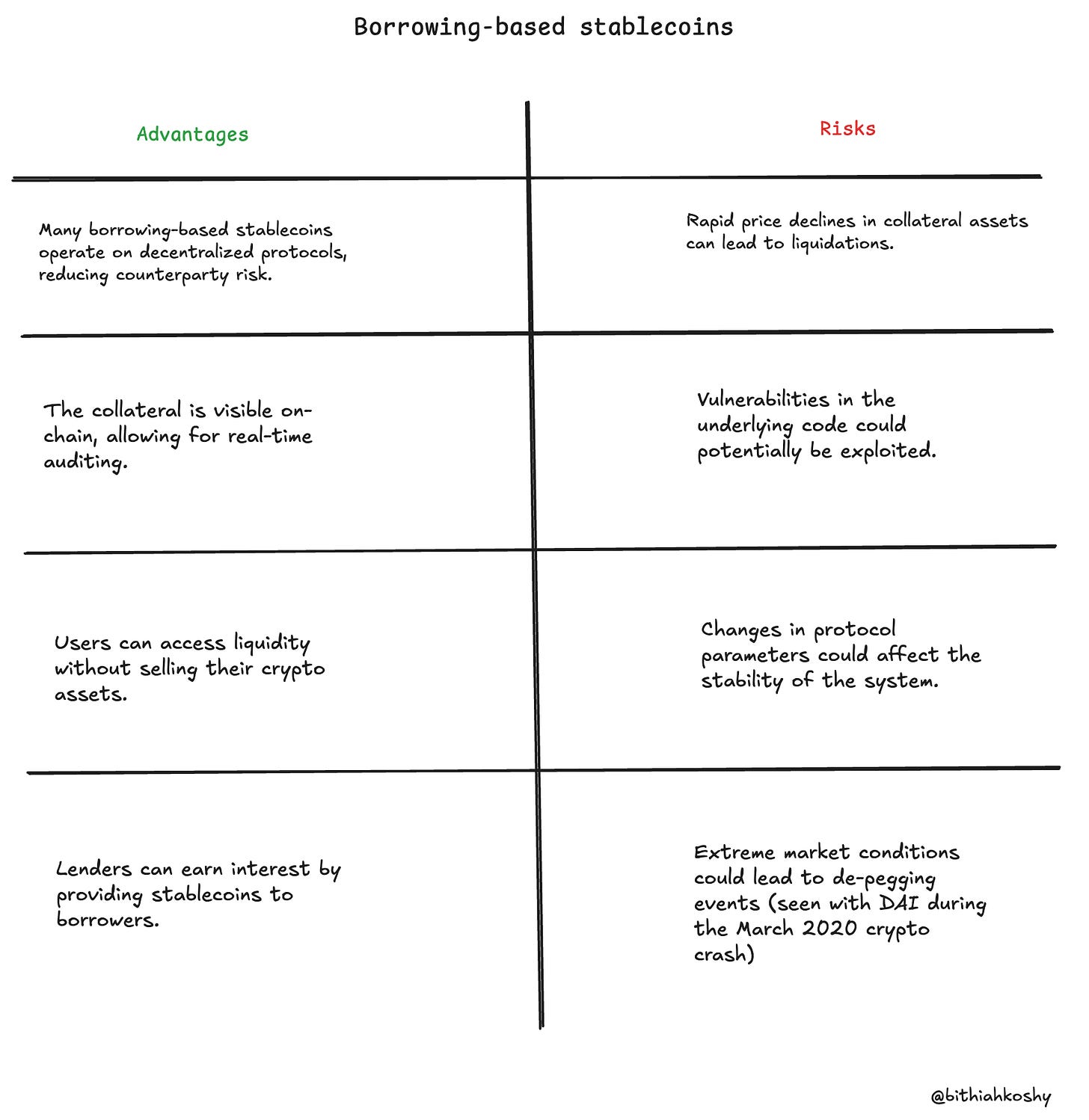

"Borrowing-based" stablecoins

"Borrowing-based" stablecoins, also known as crypto-backed stablecoins, work by having users deposit cryptocurrency as collateral and then borrow stablecoins against that collateral.

Basic mechanics

Borrowing-based stablecoins are created when users deposit cryptocurrency assets as collateral into a smart contract. In return, they can mint or borrow a certain amount of the stablecoin. The value of the collateral typically exceeds the value of the stablecoins issued (over-collateralization).

Users deposit crypto assets as collateral

Smart contracts mint stablecoins based on the collateral value

Users can borrow or withdraw the minted stablecoins

To reclaim their collateral, users must repay the borrowed stablecoins plus any accrued fees

Borrowing-based stablecoins enable users to leverage their existing crypto assets. Investors can use their holdings as collateral to borrow stablecoins and then use those to acquire more of the original asset which technically increases their exposure within the DeFi ecosystem.

DAI

DAI, created by MakerDAO, is one of the pioneering borrowing-based stablecoins. Initially it only accepted ETH as collateral but later expanded to support multiple crypto assets. DAI uses a system of Vaults to manage collateral and minting.

LUSD

LUSD, created by Liquity, is another example. It allows users to mint LUSD using ETH as collateral. LUSD aims to be more efficient than DAI with a lower collateralization ratio of 110% and a one-time fee structure.

Over-collateralization is a crucial aspect of borrowing-based stablecoins. It provides a buffer against the volatility of crypto assets used as collateral. Often, these ratios are dynamically adjusted based on market conditions and the perceived risk of the collateral assets.

Liquidation mechanisms

Liquidation is a key risk management feature in borrowing-based stablecoin systems. If the value of the collateral falls below a certain threshold, the position becomes eligible for liquidation:

Automated monitoring of collateral value

Triggering liquidation when the collateral ratio falls below the threshold

Selling the collateral to repay the borrowed stablecoins

Returning any excess collateral to the borrower

Some protocols, like Liquity use innovative approaches such as Stability Pools to manage liquidations more efficiently.

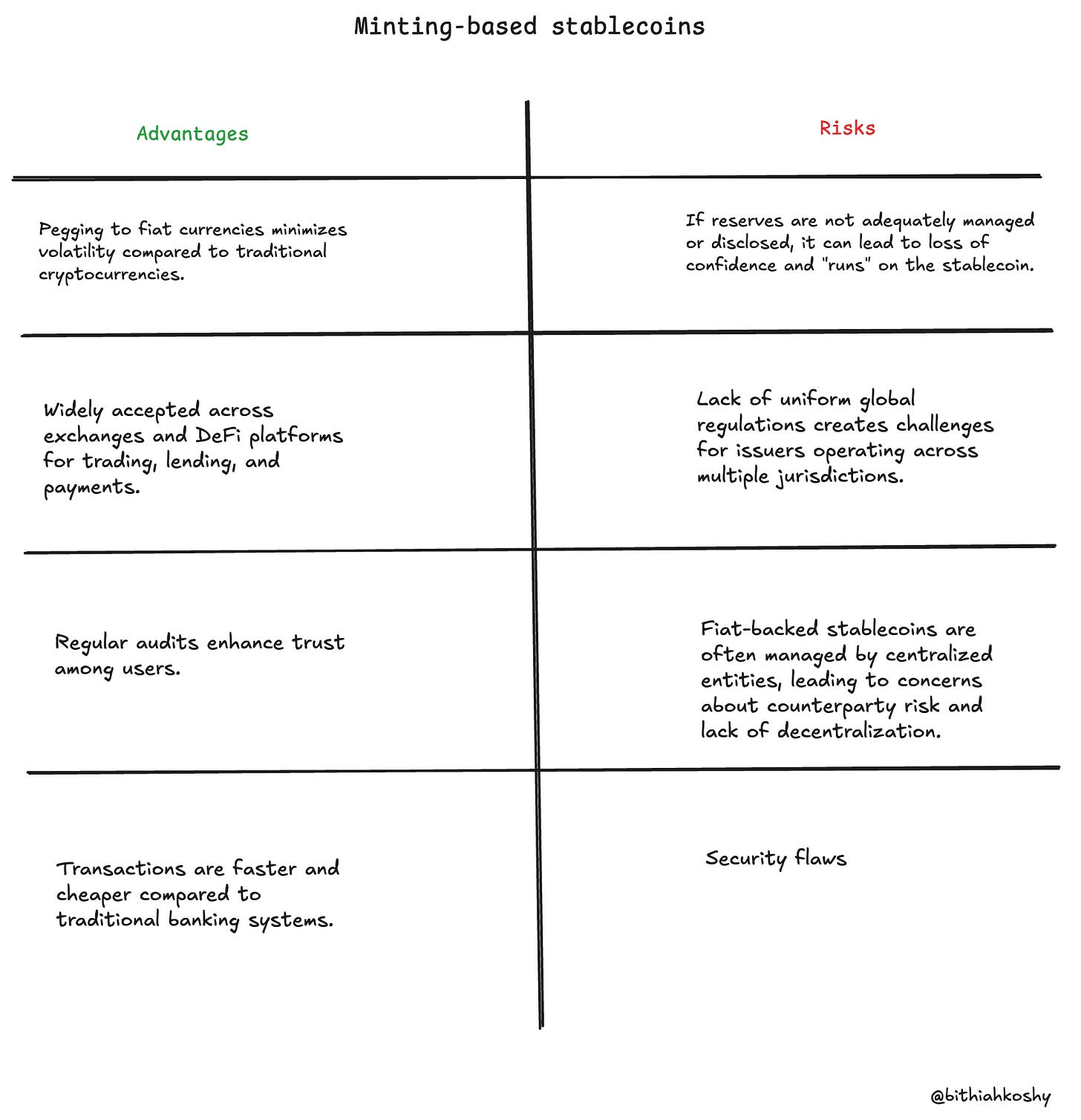

“Minting-based” stablecoins

Operational model

"Minting-based" stablecoins are digital assets designed to maintain a stable value by pegging their price to a reference asset, typically a fiat currency like the US dollar. "Minting-based" refers to the process of creating new stablecoin units when users deposit the equivalent value of the reference asset with the issuer. This process ensures that each stablecoin is backed 1:1 by reserves.

Minting: Users deposit fiat currency or equivalent assets with the issuer, who then creates an equivalent amount of stablecoins.

Redemption: Users return stablecoins to the issuer, who "burns" (removes) them from circulation and releases the corresponding fiat currency back to the user.

Peg Maintenance: The issuer ensures that the stablecoin's value remains pegged to the reference asset through reserve management and arbitrage mechanisms.

Minting-based stablecoins are often used in yield farming and staking strategies within DeFi, where users can earn rewards or interest by providing liquidity or participating in DeFi protocols.

USDC

USDC, created by Circle, maintains full backing by US dollar reserves in regulated financial institutions. Monthly audits verify this one-to-one reserve backing, ensuring transparency.

USDT

USDT, created by Tether, is the pioneer of stablecoins and remains the most widely used dollar-pegged cryptocurrency. And is backed by a mix of cash, cash equivalents, and other assets. Its deep liquidity makes it essential for crypto trading and DeFi protocols, despite occasional controversies.

Reserve management

Stablecoin issuers rely on robust reserve management to maintain trust and ensure stability. Reserves typically consist of fiat currency, short-term government securities, or other highly liquid assets. Regular audits or attestations are conducted to verify that reserves fully back circulating stablecoins. Tools like Chainlink's Proof of Reserve provide real-time transparency into reserve holdings which reduces counterparty risks.

References:

https://www.theblock.co/learn/251859/the-different-types-of-stablecoins-explained

https://www.liquity.org/blog/the-premium-of-resiliency

https://blog.chain.link/chainlink-proof-of-reserve-capital-markets/