A Brief on Fractional-Algorithmic Designs (with focus on Frax)

Stablecoin Musings #1

Fractional-algorithmic stablecoins have piqued my strong interest this past month and have decided to dedicate the first post of Stablecoin Musings on this very topic.

Understanding the basics

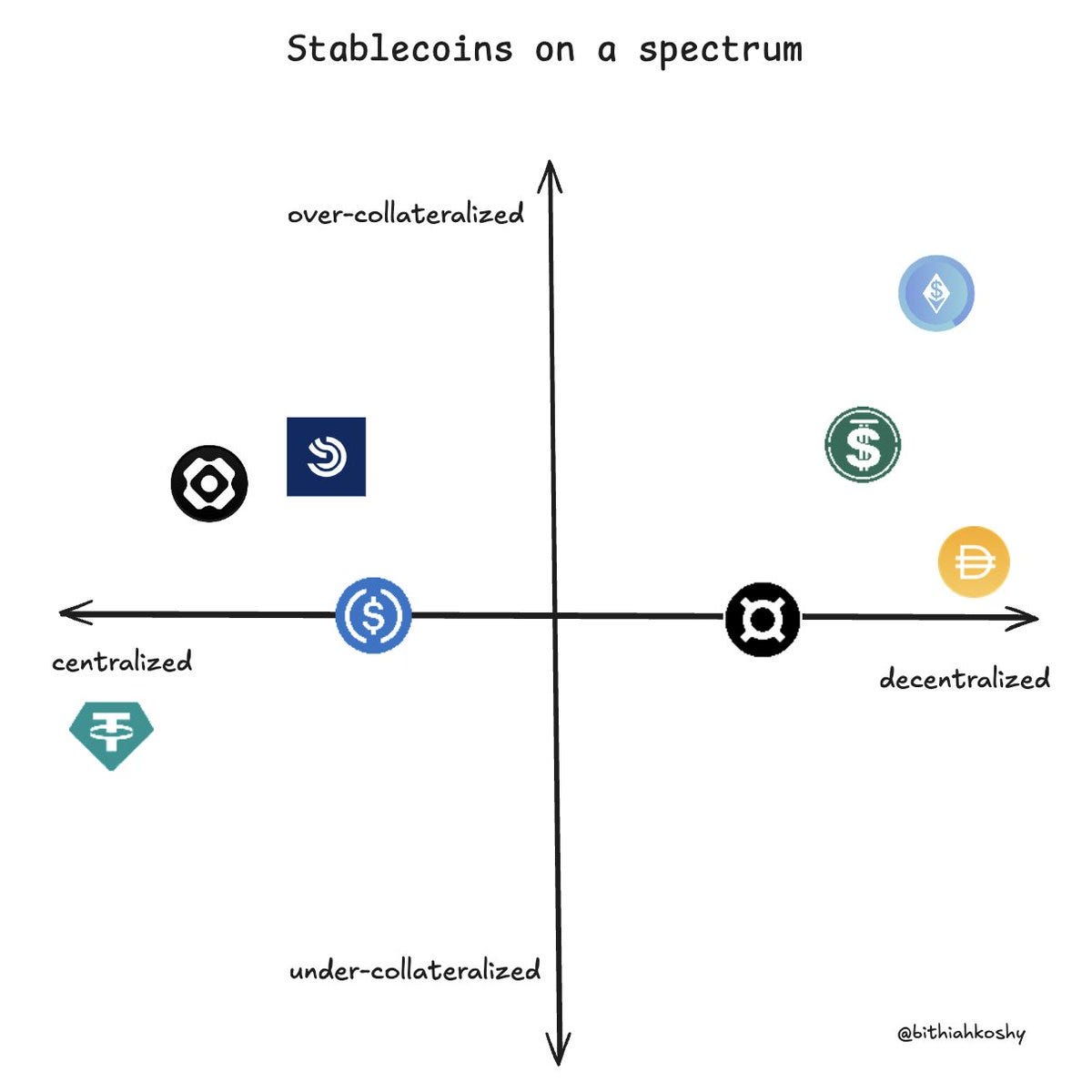

First off, what does a “fractional-algorithmic stablecoin” even mean? Stablecoins are all pegged to something. In our case, it’s pegged to a combination of partial collateral backing and algorithmic mechanisms. What does this do? Adjust the collateral ratio and token supply based on market conditions.

Partial collateral would be like USDC and other assets. Algorithmic mechanisms are automated systems that use smart contracts and code to adjust a stablecoin's token supply in response to market demand. The primary purpose for this is to maintain a stable value without relying on traditional collateral. But of course, fractional-algorithmic stablecoins are a unique blend of the two.

Where we are today

Fractional-algorithmic stablecoins were developed to create decentralized, stable-value assets without relying on fiat reserves or highly volatile crypto assets. FRAX is the first partial-collateral stablecoin. Over the past few years, FRAX has transitioned from its initial fractional-algorithmic model to a fully collateralized system as of 2023.

As of writing, it has currently a market capitalization of approximately $647 million, ranking it 9th among stablecoins and 208th among all cryptocurrencies.

The math

Role of FXS tokenomics

The FXS tokenomics model is designed as a value-capture mechanism within the Frax ecosystem, with a hard cap of 100 million tokens. The token's value accrual comes from multiple sources: protocol revenue generated by AMO (Algorithmic Market Operations) activities, fees from various protocol services, and yield generated from protocol-owned assets.

The CR (collateral ratio) is:

FXS value capture through protocol revenue:

The veFXS mechanism creates a significant incentive for long-term holding, as governance power and rewards are calculated based on both the amount locked and lock duration. Governance power through veFXS:

Revenue distribution follows a pro-rata model where each veFXS holder receives rewards proportional to their share of the total veFXS supply:

And the supply constraints are:

Are there risks?

One common risk is a sudden loss of confidence leading to a bank run, where users rush to redeem their tokens and potentially overwhelming the system's ability to maintain the peg.

A possible way this can occur is (1) if the market perceives the collateral ratio as insufficient or (2) even more generally speaking if there's a crypto market downturn. Another risk is temporary or prolonged deviations from the target price. The biggest issue with collateral is the potential for the value of the collateral assets to fluctuate or decline. Compared to pure algorithmic stablecoins, fractional models have shown more resilience against complete failures like TerraUSD.

References:

https://docs.frax.finance/frax-v3-100-cr-and-more/overview